The opening of the Albanian economy to the world brought in the first years of the transition exponential growth of this product. Not only the goods trade, fully liberalized and the growth of consumption complemented by imports has turned this into one of the most popular products of bank customers, but also the opening of free movement and mass emigration of Albanians in these three decades, have bring the need for exchanges or transfers between citizens in the country and those abroad.

Outgoing transfers

In terms of trade payments, where the principal of the transferred amount is higher, clearly the banking sector remains dominant in the supply of commercial payments. This is also due to the fact that until now, payment to the bank account has been a standard accepted by both the sender and the recipient of the goods and often, part of the contract, although this is also changing with the increasing weight of trade with countries like China. or other Far Eastern countries, which accept payments through channels other than bank payments.

While in the part that deals with payments from or to individuals, where the principal of the amount sent is significantly smaller compared to the commercial transfer, clearly, here the choices are greater. In addition to banks, SFJB have also created more choices for the consumer, offering products that are liked and have received more and more of the time offered by banks.

Given that for this generation of principal remittances, SFJBs have a much better offer than Banks and a shorter delivery time than a similar cross-border banking product, the former are increasingly attracting the individual client, who will to send such an amount outside Albania, becoming an important factor in this part of the market.

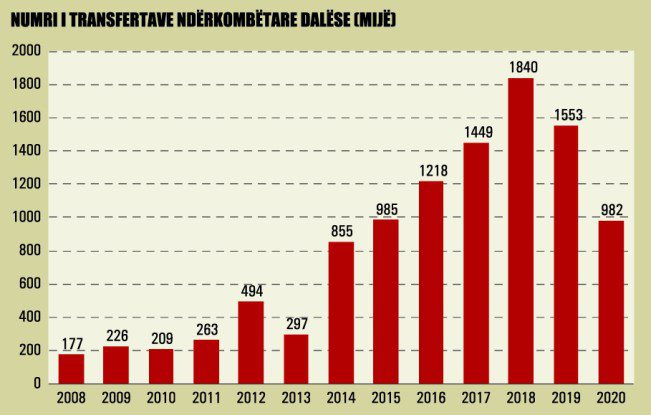

While the performance of national payments was not greatly hampered by the pandemic, the opposite happened with international payments. According to the Bank of Albania, the clients of the Albanian banking sector made only 982 thousand international payments last year, a significant decrease of almost 37% compared to a year ago. The decline came especially from the segment of individuals, by about 40% compared to a year ago, while for businesses, the decline was more limited, by about 9.5%.

The strong decline in the segment of individuals can be interpreted as a decrease in the purchase of goods and services abroad by Albanians, due to severe movement restrictions caused by the pandemic. These transfers include payments for booking plane tickets, hotels abroad, payments for commercial purchases abroad, etc.

However, in monetary terms, the decline was more limited compared to the number of transactions. For the previous year, the value of international transfers initiated from individuals’ accounts was ALL 54.6 billion, 12.8% less compared to a year ago. A more pronounced decline in the number of transactions than in value may be an indication that the pandemic has affected small value payments more.

Incoming transfers

While outgoing international remittances declined sharply, inbound remittances had less impact. According to the Bank of Albania, international transfers received in the accounts of Albanian businesses and individuals were about 1.61 million, down by only 0.9% compared to a year ago. The decline all came from the segment of individuals, while transfers to business accounts again marked a slight increase compared to a year ago.

In parallel, data on the value of inbound transfers to individuals’ bank accounts show that already, a smaller share of remittances enters through the banking sector (about 37%). More and more, migrant clients are turning to world-renowned companies, which have a physical or digital presence in the countries where they work and live (Western Union, MoneyGram or RIA, but also others in recent years), but at the same time are active in Albania for many years, through cooperation with SFJB locally licensed, or even in a good part of the System Banks, in the country, providing payment services to the host individual in Albania.

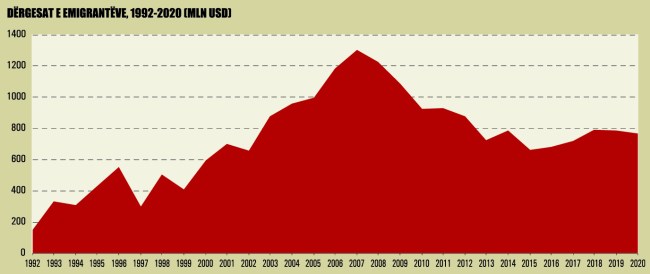

The fact that Albania has “exported” about 1.5 – 1.6 million citizens in these 30 years of transition has made remittances an important factor in the lives of hundreds of thousands of families and at the same time in the economic life of the country. The attention to emigration is great, not only for the fact that remittance remittances are an important part of payment services, but also that emigrants are important clients in the context of bank deposits.

Always valued as an important part of net national income, remittance flows have been measured since the first years of Albanian emigration at several hundred million euros. They have fluctuated, also depending on the economic performance of countries where Albanians have emigrated en masse.

Data from the Bank of Albania showed that last year, remittances amounted to 673 million euros. After several consecutive years of steady growth, supported by the latest wave of Albanian emigration in the last decade, the value of remittances fell by about 4%.

The massive impact of the pandemic on the European economy has naturally affected the emigrant households and thus the opportunity to help the remaining family in Albania. If we add the income from work abroad, the total value of remittances reached about 894 million euros, even in this case, in annual decline, by about 10.7%.

Especially in the last decade when the use of internet or mobile applications of these brands has increased (Western Union, MoneyGram or RIA, but also others in recent years, such as TransferWise, Xoom, PaySend or Remitly, etc., etc.). Their offer for emigrants working in the most developed countries for the commissions of these services has gone to very low levels and have become virtually uncompetitive from traditional bank payments both in terms of transfer cost and the time of principal delivery. sent.

These companies have become a specialized channel for the remittance market and their massive presence in the countries where Albanians have emigrated (Italy, Greece, Germany, USA, or Great Britain) makes them an important channel for sending money by emigrants as well. Albanians.

Since the transfer service of these international brands is made against the total payment of the commission by the Shipper from the moment when the shipment is made and without any payment by the Recipient, when he collects the amount sent, the competition in Albania regarding these services is done in terms of the reliability of the respective brand in Albania during the years of operation, the spread of its physical service network, but also with the quality of service provided by the local entity.

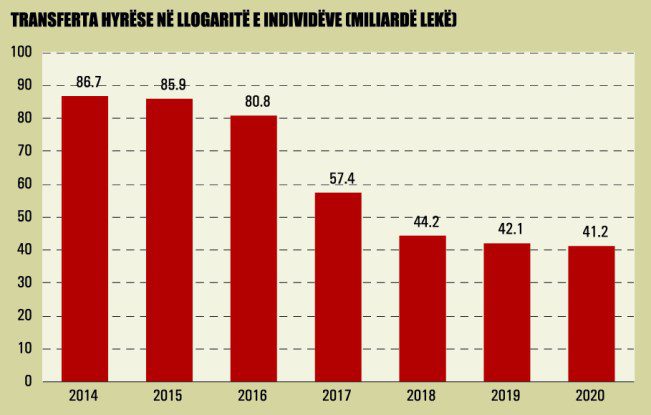

Last year, individuals in Albania received about ALL 41.2 billion, or about EUR 333 million in transfers from abroad to their bank accounts. Data from the Bank of Albania show that transfers from abroad to the accounts of Albanian individuals decreased for the sixth consecutive year.

Compared to 2019, the decline in the value of transfers was 2.1%, while compared to five years ago, money coming from abroad into individuals’ accounts has halved. In the long run, this tendency has come partly from the statistical effect of the exchange rate and the depreciation of the Euro at the exchange rate with the Lek.

The effect of the exchange rate is also indirectly evidenced by the fact that, in number, inbound transfers to individuals’ accounts have a slight upward trend year after year. Despite this, bank transfers account for a small part of the inflows from abroad that benefit Albanian households.

For the most part, remittances come through money transfer companies or informally. Experts explain that the average value of transfers sent to Albania is low, in the range of 200-300 euros.

For these amounts, the commissions paid by the senders to the transfer companies are lower compared to those paid for a similar product to the commercial banks of the countries from where this money is sent. Transfer companies also have the advantage of enabling real-time transfers, while by bank transfer, execution takes several business days.

Even 30 years after the start of mass emigration, remittances remain an important source for the Albanian economy, especially for the poorest segments of the population. A survey by the Bank of Albania has shown that remittances are a source of income for about 26% of Albanian households. For households receiving remittances, they account for about 90% of their total income, which clearly proves an almost complete economic dependence on them, for about a quarter of households.

If financial inclusion is a problem for the entire Albanian society, for the segment of households that receive remittances, this problem is even more pronounced. According to the survey, only 7.5% of households receiving remittances have a bank account.

Restriction of movement brought more deliveries to formal channels

Although the Bank of Albania statistics show a slight decrease in remittances last year, the pandemic has brought positive developments in this segment of remittances. Elton Çollaku, administrator of the Financial Union Tirana, says for the magazine “Monitor” that the restrictions on cross-border movement of citizens significantly affected the channels of entry of remittances.

“Another element that affected 2020 was the significant restriction of the movement of people outside the borders. This led to a significant increase in the channeling of transfers from informal channels throughout the network of financial operators, including banks and non-bank financial entities – SFJB. Unable to bring money by hand, through acquaintances or transport lines, Albanian emigrants sent more money through formal channels. This was undoubtedly favored by the lower tariffs for online services “, says Mr. Çollaku.

The use of informal channels to send remittances is a feature of these transfers worldwide. Emigrants generally come from less developed countries, where financial inclusion is also weaker. Money transfer operators for years also offer the possibility of making online transfers. This form has reduced costs and made it easier to access formal channels, giving impetus to increasing their use.