26.05.2021 – 18:33

From July 1, the way the compulsory vehicle insurance market will work will change.

Ervin Mete, director of the Financial Supervision Authority says that with the entry into force of the new law governing this sector, there are some innovations that will bring improvement in obtaining compensation for consumers: deadlines are shortened, and for some procedures do not must be the presence of the police.

“The new law is closer to EU directives and brings some positive aspects to consumers by shortening procedures, deadlines and in the case of minor damages the presence of the police is avoided.”

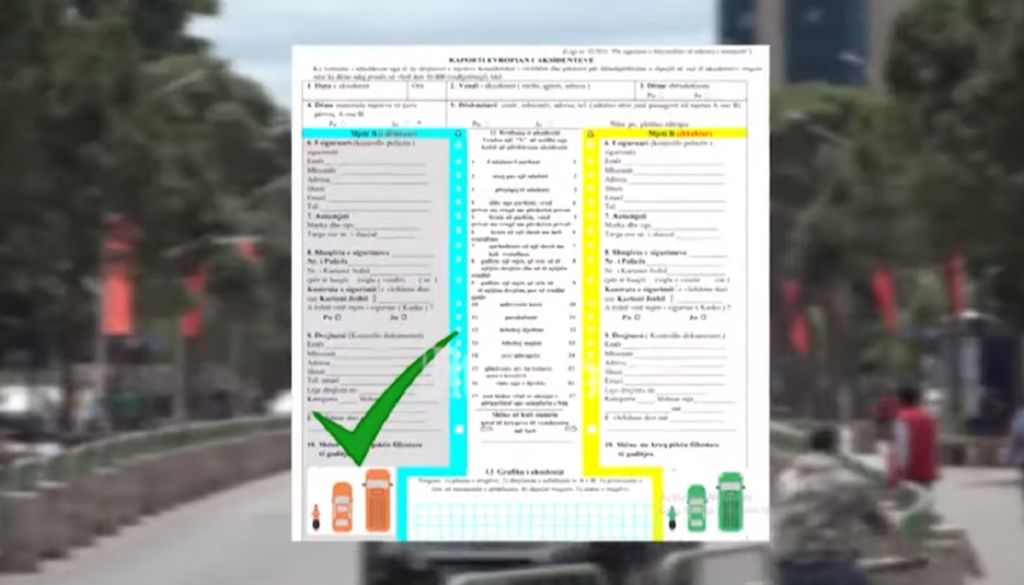

For the first time, citizens will have with them the European Accident Report, which gives them the opportunity to resolve by agreement damages worth up to 30 thousand Lekë. Mete says that even those who have cut police before this date should get this report from the companies.

“The report should also be received from drivers who have already cut a security policy. In any case, the assessment of the damage is done by the insurance company and with an agreement, health damages cannot be resolved, but only the property ”.

Now if someone is harmed by an uninsured party, the claim for compensation will be made to the company where his vehicle is secured, and then it will be the company that will claim the amount of the Compensation Fund and not the citizen.

This innovation for the head of the AFSA shortens the long waits for years of a category of injured.

“Most of those who go to the Compensation Fund today are eliminated and the deadlines for receiving compensation are shortened.”

The law increases by 50% the limits of liability for private vehicles and by 30% for those in the field of public transport, this will affect that the value of compensation based on the company’s assessment will be higher than today.

REMOTE_ADDR:[]